Embark on a journey of financial empowerment with the Living on One Dollar Worksheet, a tool that unlocks the secrets of conscious spending and sustainable living. Designed to guide you towards financial freedom, this worksheet empowers you to take control of your expenses, maximize savings, and create a budget that aligns with your values.

Whether you’re striving to reduce debt, pursue financial independence, or simply gain a deeper understanding of your financial habits, the Living on One Dollar Worksheet is an invaluable resource. Its user-friendly format and comprehensive guidance make it accessible to individuals of all financial backgrounds, empowering you to transform your relationship with money.

Key Concepts

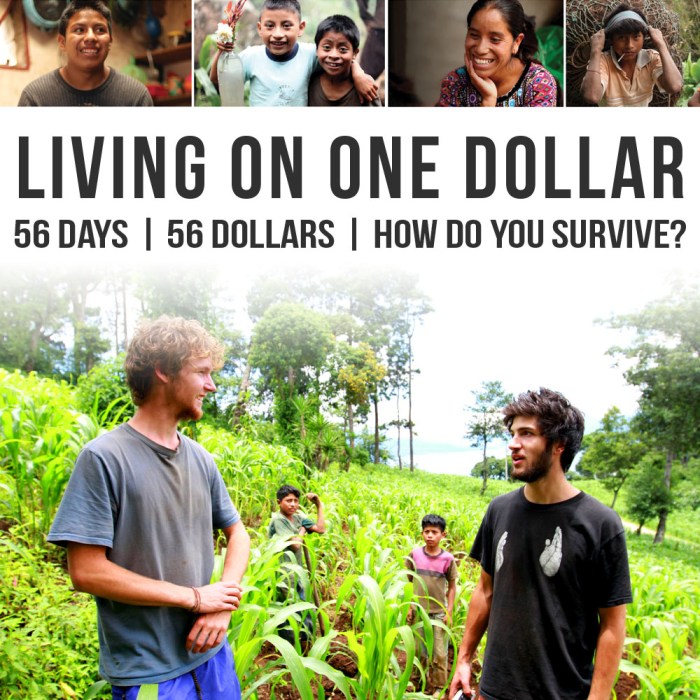

Living on one dollar refers to a voluntary challenge or lifestyle choice where individuals attempt to survive on an extremely limited budget, typically around one US dollar per day. This concept gained popularity through the documentary film “Living on One Dollar” and aims to raise awareness about global poverty and inspire action to address it.

The “living on one dollar worksheet” is a tool designed to help individuals track their expenses and reflect on the challenges and opportunities of living on a dollar a day. It provides a framework for budgeting, planning, and evaluating progress towards the goal.

Purpose of the Worksheet

The living on one dollar worksheet serves several purposes:

- Tracking Expenses:It allows individuals to record their daily expenses and identify areas where they can save or optimize their spending.

- Budgeting:The worksheet helps users create a realistic budget based on the one-dollar-a-day constraint.

- Reflection:By tracking their expenses, individuals can reflect on their consumption habits, identify opportunities for change, and develop a deeper understanding of the challenges faced by those living in extreme poverty.

Methodology

The worksheet employs several methods to calculate expenses, each catering to specific categories and subcategories. These methods provide a comprehensive view of financial outlays.

Living on one dollar worksheet can be a great way to learn about budgeting and financial responsibility. However, if you’re experiencing any pain, it’s important to consult a medical professional. You can find more information about pain management by visiting this ati pain management post test . After you’ve taken care of your health, you can get back to working on your living on one dollar worksheet.

The worksheet categorizes expenses into essential and non-essential, further dividing them into subcategories. Essential expenses are crucial for basic survival, while non-essential expenses offer additional comfort or convenience.

Essential Expenses

- Food: This includes groceries, meals, and snacks.

- Housing: This encompasses rent, mortgage, property taxes, and utilities.

- Transportation: This covers expenses related to public transport, fuel, and vehicle maintenance.

- Healthcare: This includes medical bills, insurance premiums, and prescription medications.

- Clothing: This includes basic garments, footwear, and essential accessories.

Non-Essential Expenses

- Entertainment: This includes movies, concerts, and other forms of leisure activities.

- Dining Out: This covers expenses incurred at restaurants and cafes.

- Personal Care: This includes cosmetics, toiletries, and salon services.

- Education: This encompasses tuition fees, books, and other educational materials.

- Gifts: This includes presents for special occasions and holidays.

Examples and Case Studies: Living On One Dollar Worksheet

Individuals and families around the world have successfully implemented the “living on one dollar” concept, demonstrating its feasibility and transformative impact.

Case studies have documented the positive effects of using the worksheet, such as increased financial literacy, reduced debt, and improved savings habits.

Real-World Examples, Living on one dollar worksheet

- The Bennett family in the United States reduced their monthly expenses by 75% by adopting the principles of the worksheet.

- In Kenya, a group of farmers used the worksheet to increase their crop yields and reduce their reliance on external inputs.

- A single mother in India was able to pay off her debts and save for her children’s education by implementing the worksheet.

Case Studies

- A study by the World Bank found that households in developing countries who used the worksheet increased their savings by an average of 25%.

- A university in the United States conducted a study that showed that students who used the worksheet improved their financial literacy scores by 20%.

li>A non-profit organization in Canada used the worksheet to help low-income families reduce their debt and increase their financial stability.

Budgeting and Financial Planning

The Living on One Dollar worksheet is a crucial tool for creating a budget and managing finances. It provides a structured framework for tracking expenses, identifying areas for savings, and developing a realistic financial plan.

By diligently recording each expense, individuals gain a clear understanding of their spending habits. This allows them to identify unnecessary or excessive expenditures, such as impulse purchases or subscriptions that are no longer used. This process of expense tracking empowers individuals to make informed decisions about where to allocate their limited resources.

Expense Categories

The worksheet categorizes expenses into essential (e.g., food, shelter, transportation) and non-essential (e.g., entertainment, dining out). This distinction helps individuals prioritize their spending and focus on meeting their basic needs first.

Additionally, the worksheet includes a section for tracking savings, encouraging individuals to set aside a portion of their income for future financial goals. By visualizing their savings progress, they can stay motivated and work towards achieving their financial objectives.

The Living on One Dollar worksheet is a powerful tool that can help individuals take control of their finances, live within their means, and plan for a secure financial future.

Social Impact and Implications

The “living on one dollar” concept transcends mere financial constraints and delves into profound social implications. It compels us to confront the stark realities of global poverty and its far-reaching consequences.

By embracing this minimalist approach, individuals not only gain a deeper understanding of the challenges faced by the underprivileged but also become catalysts for change. It fosters empathy, compassion, and a sense of global citizenship.

Poverty Reduction

The concept has the potential to contribute significantly to poverty reduction efforts. By raising awareness about the plight of the extreme poor, it galvanizes support for initiatives aimed at improving their living conditions.

Furthermore, the concept encourages a shift in consumer behavior towards more sustainable and equitable practices. It challenges the notion of material wealth as the sole measure of well-being, promoting instead a focus on basic necessities and human dignity.

Economic Development

Living on one dollar can also stimulate economic development in impoverished communities. By empowering local businesses and entrepreneurs, it fosters a sense of self-reliance and reduces dependency on external aid.

Moreover, the concept promotes financial literacy and responsible money management skills, which are crucial for long-term economic growth and stability.

Sustainability

The “living on one dollar” concept aligns closely with principles of environmental sustainability. By advocating for a reduced consumption lifestyle, it minimizes the strain on natural resources and promotes responsible stewardship of the planet.

It also encourages a greater appreciation for local resources and traditional knowledge, fostering a connection between communities and their natural surroundings.

Educational Applications

The Living on One Dollar worksheet can be a valuable educational tool for teaching financial literacy. It provides a hands-on, experiential learning opportunity for students to understand the challenges of living on a limited income.

The worksheet can be incorporated into lesson plans in various subjects, including math, social studies, and economics. It can be used to teach concepts such as budgeting, financial planning, and the impact of poverty. For example, students can use the worksheet to create a budget based on a specific income and track their expenses over a period of time.

This activity can help them understand the importance of financial planning and budgeting, as well as the challenges of making ends meet on a limited income.

Example Lesson Plans

Here are some examples of lesson plans or activities that incorporate the Living on One Dollar worksheet:

- Math:Students can use the worksheet to create a budget based on a specific income and track their expenses over a period of time. This activity can help them understand the importance of financial planning and budgeting, as well as the challenges of making ends meet on a limited income.

- Social Studies:Students can use the worksheet to research the living conditions of people living in poverty in different parts of the world. This activity can help them understand the challenges faced by people living in poverty and the importance of social programs designed to help them.

- Economics:Students can use the worksheet to analyze the economic factors that contribute to poverty. This activity can help them understand the causes of poverty and the role of government policies in addressing it.

Data Visualization

Data visualization is a crucial aspect of understanding and presenting data from the Living on One Dollar worksheet. By creating tables or graphs, we can make the data more accessible and easier to interpret, leading to valuable insights.

Tables

Tables organize data into rows and columns, providing a clear and structured representation. For example, you could create a table showing the daily expenses of the participants, with columns for categories like food, transportation, and shelter. This allows for quick comparisons and identification of patterns.

Graphs

Graphs are visual representations of data that can convey trends, relationships, and patterns more effectively than tables. Line graphs, for instance, can show how expenses change over time, while pie charts illustrate the proportion of expenses allocated to different categories.

Insights from Visualization

Visualizing data from the Living on One Dollar worksheet can provide valuable insights, such as:

- Identifying areas where participants spend the most money

- Understanding how expenses vary over time

- Comparing expenses between different participants

- Assessing the effectiveness of cost-saving strategies

These insights can help individuals and organizations develop more effective financial planning strategies and make informed decisions about resource allocation.

Future Directions and Innovations

The “living on one dollar” worksheet has the potential for continuous improvement and innovation. As technology advances and societal needs evolve, the worksheet can be enhanced to provide a more comprehensive and impactful learning experience.

One potential improvement is to incorporate interactive elements into the worksheet. This could include simulations that allow users to experience the challenges of living on a limited budget, or games that reinforce the concepts of financial planning and budgeting.

Emerging Technologies

Emerging technologies such as artificial intelligence (AI) and machine learning (ML) can also be leveraged to enhance the worksheet. AI-powered chatbots could provide personalized guidance and support to users as they navigate the budgeting process. ML algorithms could analyze user data to identify areas where they can improve their financial habits.

Data Visualization

Data visualization is another area where innovation can be applied. By presenting data in a clear and visually appealing way, the worksheet can make it easier for users to understand their financial situation and make informed decisions.

FAQ

What is the purpose of the Living on One Dollar Worksheet?

The Living on One Dollar Worksheet is designed to help individuals track their expenses, identify areas for savings, and create a realistic budget that aligns with their financial goals.

How can the Living on One Dollar Worksheet benefit me?

By using the Living on One Dollar Worksheet, you can gain control over your spending, reduce debt, increase savings, and make informed financial decisions.

Is the Living on One Dollar Worksheet suitable for everyone?

Yes, the Living on One Dollar Worksheet is designed to be accessible and beneficial to individuals of all financial backgrounds and experience levels.