Cruz company post closing trial balance – The Cruz Company Post-Closing Trial Balance serves as a crucial component of the accounting cycle, providing a comprehensive overview of the company’s financial position after closing entries have been recorded. This guide delves into the purpose, components, preparation, and uses of this essential financial statement.

The post-closing trial balance plays a pivotal role in ensuring the accuracy and completeness of the accounting records. It enables accountants to verify that the total debits equal the total credits, ensuring that all transactions have been properly recorded and processed.

Post-Closing Trial Balance: Overview

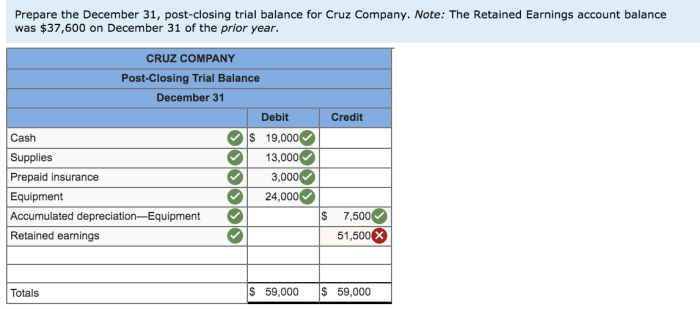

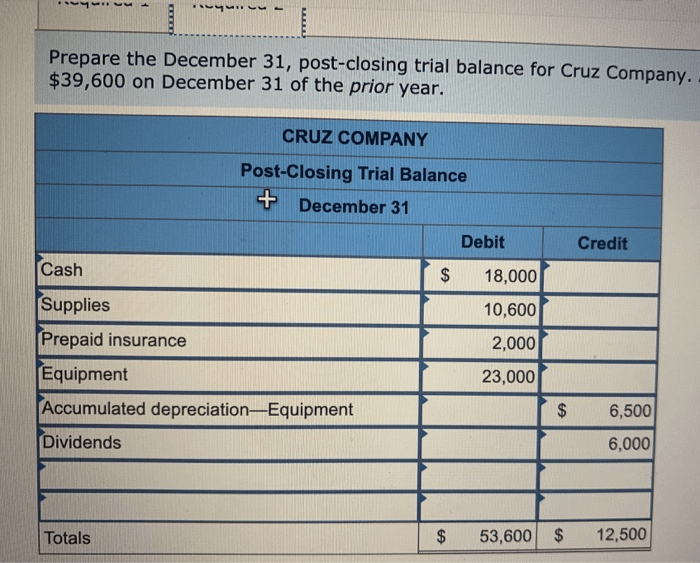

A post-closing trial balance is a financial statement prepared at the end of an accounting period after all closing entries have been recorded. It provides a summary of the balances in all ledger accounts, ensuring that the debits equal the credits.

Its significance lies in its role as a control tool, verifying the accuracy of the accounting records and ensuring that the financial statements are complete and balanced. It also serves as a starting point for the next accounting period.

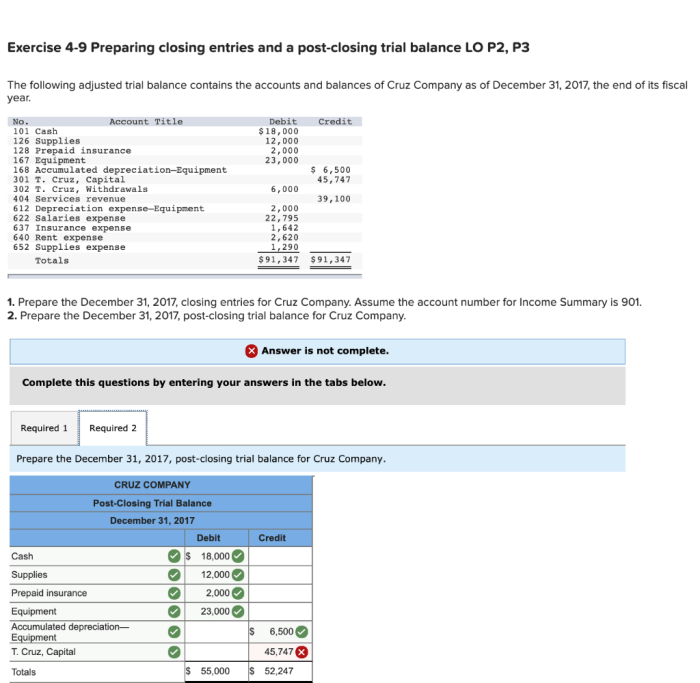

An example of a post-closing trial balance includes:

| Account | Debit | Credit |

|---|---|---|

| Cash | $10,000 | |

| Accounts Receivable | $20,000 | |

| Inventory | $30,000 | |

| Total Debits | $60,000 | |

| Total Credits | $60,000 |

Components of a Post-Closing Trial Balance

The key components of a post-closing trial balance include:

- Account Name:The title of the ledger account.

- Debit Balance:The total of all debit entries in the account.

- Credit Balance:The total of all credit entries in the account.

The structure of a post-closing trial balance is as follows:

| Account Name | Debit Balance | Credit Balance |

|---|---|---|

| Assets | $X | |

| Liabilities | $Y | |

| Owner’s Equity | $Z | |

| Total Debits | $X | |

| Total Credits | $X |

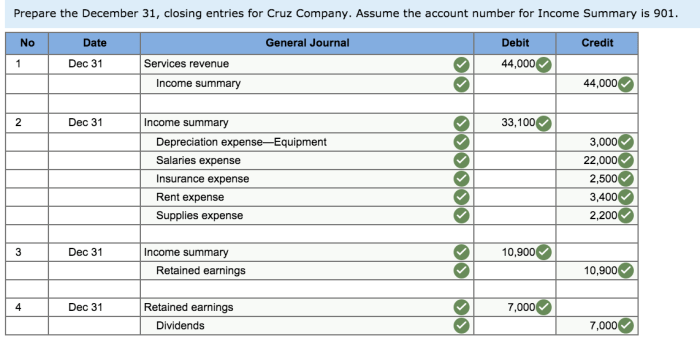

Preparing a Post-Closing Trial Balance: Cruz Company Post Closing Trial Balance

The steps involved in preparing a post-closing trial balance include:

- Record all closing entries.

- Prepare a trial balance.

- Verify that the debits equal the credits.

- Make any necessary adjustments.

Accuracy and completeness are crucial in preparing a post-closing trial balance. A checklist of considerations includes:

- All closing entries have been recorded.

- The trial balance is balanced.

- The post-closing trial balance is reconciled with the financial statements.

Uses of a Post-Closing Trial Balance

A post-closing trial balance has various uses, including:

- Control Tool:Verifying the accuracy of the accounting records.

- Starting Point:For the next accounting period.

- Financial Reporting:Supporting the preparation of financial statements.

- Decision-Making:Providing insights into the financial health of the business.

Businesses use post-closing trial balances to:

- Identify accounting errors.

- Monitor financial performance.

- Prepare financial statements.

- Make informed business decisions.

Relationship to Other Financial Statements

A post-closing trial balance is closely related to other financial statements, including:

- Balance Sheet:Provides a snapshot of the business’s financial position at a specific point in time.

- Income Statement:Summarizes the business’s revenues and expenses over a period of time.

- Statement of Cash Flows:Shows the movement of cash and cash equivalents over a period of time.

The following diagram illustrates the interconnections between these financial statements:

[Diagram of the interconnections between the post-closing trial balance, balance sheet, income statement, and statement of cash flows]

Answers to Common Questions

What is the purpose of a post-closing trial balance?

The purpose of a post-closing trial balance is to verify the equality of total debits and total credits in the accounting records after closing entries have been recorded.

What are the key components of a post-closing trial balance?

The key components of a post-closing trial balance include the account names, account balances, and debit or credit balances.

How is a post-closing trial balance used?

A post-closing trial balance is used for financial reporting, decision-making, and ensuring the accuracy and completeness of the accounting records.