A company pledges its receivables so it can: – A company pledges its receivables so it can access a range of financial benefits, including increased borrowing capacity, improved cash flow, and potential tax implications. This strategic move involves using outstanding invoices as collateral to secure funding, offering companies a flexible and cost-effective alternative to traditional financing methods.

Pledging receivables is a common practice in business, enabling companies to tap into their accounts receivable and unlock their value. By understanding the concept of receivables, the process of pledging, and the potential benefits and considerations involved, companies can make informed decisions about whether this financing option aligns with their strategic goals.

Understanding Receivables

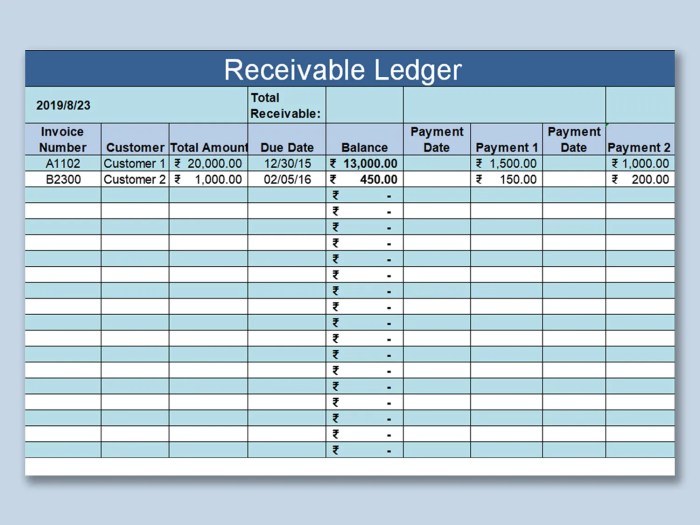

Receivables are amounts owed to a business by its customers for goods or services sold on credit. They represent a valuable asset for businesses, as they indicate the company’s ability to generate future cash flow. Common types of receivables include accounts receivable, notes receivable, and trade acceptances.

Managing receivables effectively is crucial for businesses. Efficient receivables management helps ensure timely collection of payments, reduces the risk of bad debts, and improves cash flow. Proper management involves establishing clear credit policies, implementing effective billing and collection procedures, and monitoring receivables aging regularly.

Pledging Receivables

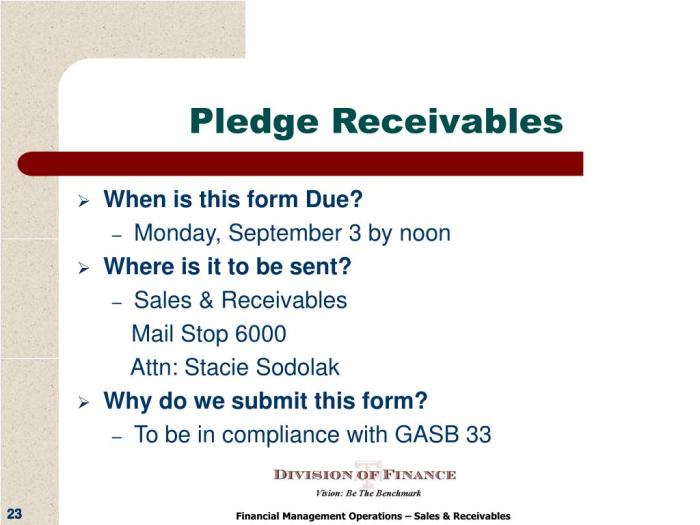

Pledging receivables is a financing technique where a company uses its receivables as collateral to secure a loan or line of credit. By pledging receivables, businesses can access additional funding without having to sell off assets or take on equity financing.

The process of pledging receivables involves entering into a legal agreement with a lender, such as a bank or factoring company. The agreement Artikels the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and the specific receivables pledged as collateral.

Companies pledge their receivables for various reasons. These may include the need for additional working capital, expansion of operations, or to finance large projects. Pledging receivables can also be used to improve a company’s credit rating and gain access to more favorable loan terms.

Benefits of Pledging Receivables

- Increased borrowing capacity:Pledging receivables allows businesses to borrow more money than they would be able to without collateral. This can be particularly beneficial for companies with limited access to traditional financing options.

- Improved cash flow and liquidity:The proceeds from a loan secured by receivables can be used to improve a company’s cash flow and liquidity. This can help businesses meet their ongoing operating expenses and invest in growth opportunities.

- Potential tax implications:In some cases, pledging receivables can provide tax benefits. For example, the interest paid on a loan secured by receivables may be tax-deductible.

- Risk of default:If a company defaults on its loan obligations, the lender may have the right to seize and liquidate the pledged receivables. This can result in a significant loss of revenue and damage to the company’s reputation.

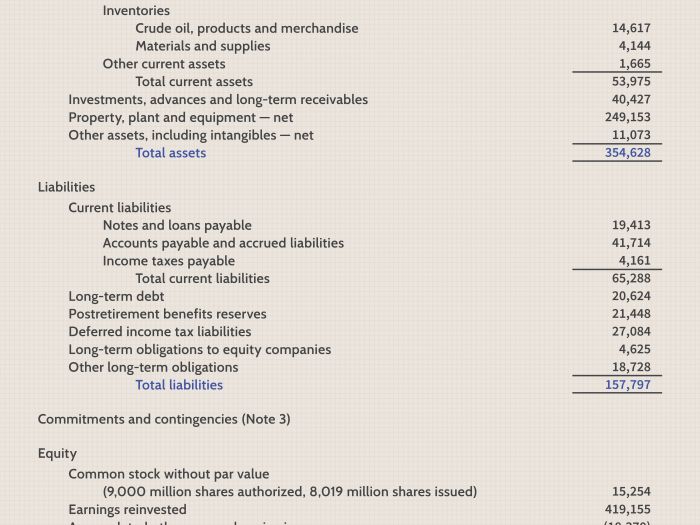

- Impact on financial statements:Pledging receivables can impact a company’s financial statements. The pledged receivables will be shown as a secured liability on the balance sheet, which can affect the company’s debt-to-equity ratio and other financial metrics.

- Suitability evaluation:Not all companies are suitable for pledging receivables. Factors to consider include the quality of the receivables, the company’s financial condition, and the availability of alternative financing options.

- Lines of credit:A line of credit is a revolving loan that allows businesses to borrow up to a predetermined limit. Lines of credit are typically secured by a blanket lien on the company’s assets.

- Invoice factoring:Invoice factoring is a financing technique where a company sells its unpaid invoices to a factoring company at a discount. Factoring can provide immediate cash flow but can also be more expensive than traditional financing options.

- Venture capital:Venture capital is a type of equity financing where investors provide funding to early-stage or high-growth companies in exchange for an ownership stake.

Considerations When Pledging Receivables

While pledging receivables can provide several benefits, it is important to consider the associated risks and implications.

Alternatives to Pledging Receivables: A Company Pledges Its Receivables So It Can:

There are several alternative financing options available to companies that need additional funding without pledging receivables.

Clarifying Questions

What are the key benefits of pledging receivables?

Pledging receivables provides several key benefits, including increased borrowing capacity, improved cash flow and liquidity, and potential tax implications.

What are the risks associated with pledging receivables?

Pledging receivables carries certain risks, such as the potential impact on the company’s financial statements, the risk of default on the loan, and the potential loss of control over the receivables.

How can companies evaluate the suitability of pledging receivables?

Companies should carefully consider their financial situation, the terms of the loan, and the potential impact on their business operations before deciding whether pledging receivables is the right financing option for them.